(Photo Courtesy: Carol M. Highsmith Archive, Library of Congress)

Details and Impacts of New Federal Law Will Take Time to Figure Out

Notes readers are likely well aware of significant federal legislation that passed and was signed into law during the 4th of July week. We are still in the place of having more questions than answers, but it is clear the new law will dramatically impact Washington children and families with sweeping changes to Medicaid and SNAP, among other provisions.

Because the bill was being amended up to nearly the final vote, many details are still being unearthed. It is going to take some time to first figure out what the bill does before it can be determined to the degree to which it will impact Washingtonians (and our state budget).

One thing we do know is that the 2025-27 biennial budget did not account for this new federal law and as discussed below in the section on the state’s revenue forecast, our state is not currently in the fiscal position to fully backfill this loss in federal funding to SNAP or Medicaid.

Governor Ferguson is on the record saying that – as of now – he is not looking to call the Legislature back for a special session prior to January 2026, but that could change based on future revenue forecasts or other developments coming out of Washington D.C.

In short, stay tuned. Much more to come.

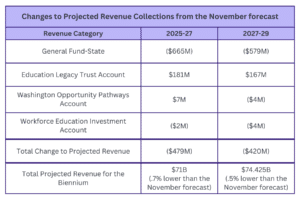

June State Revenue Forecast

On a quarterly basis, the Washington State Economic and Revenue Forecast Council meets to receive a forecast of the state’s revenue outlook from the state’s economist, Dave Reich. These revenue forecasts are designed to “promote state government financial stability by producing an accurate forecast of economic activity and General Fund revenue for the Legislature and the Governor to be used as the basis of the state budget.”

In many ways, the June and September forecasts are “temperature checks.” The March forecast informs the Legislature as they finalize their budgets, and the November forecast informs the Governor as they finalize their proposed budget.

The state’s economist job is a challenging one – especially now – because the economist is modeling with a great deal of uncertainty, particularly from the federal level. Questions surrounding the imposition of tariffs and international conflict(s) all make accurate forecasting risky. Additionally, state revenue collections continue to be slow.

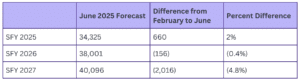

The most recent revenue forecast was on June 24, 2025, prior to the enactment of the “Big Beautiful Bill.” With the information the state economist had at that point in time, funds subject to the budget outlook were projected to decrease by $720 million over the four-year outlook from the revenue amount contained in the budget passed in April and signed into law in May.

Much of the projected revenue decline is in the 2027-29 biennium ($638 million). Higher than expected revenues for the 2023-25 biennium of $407 million helped offset the projected drop in funds for the 2025-27 biennium ($490 million).

It is also important to note that the budget outlook for the 2025-27 biennium adopted by the State Economic and Revenue Forecast Council on June 10, 2025 (before the most recent revenue forecast) assumes an ending balance of $590 million in State Fiscal Year 2026 and just $80 million in State Fiscal Year 2027. The ending balance dips into the negative in State Fiscal Year 2028 at ($56 million). This is all to say the state budget was running on thin margins – before the June forecast and the enactment of the “Big Beautiful Bill.”

State Caseload Forecast

In contrast to the revenue forecasts which focus on state resources, state caseload forecasts center on expected enrollment and participation in state entitlement programs such as K-12 education, prisons and Medicaid (the budget’s big cost drivers).

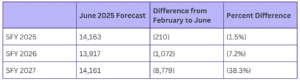

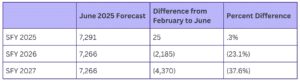

The June 11th Caseload Forecast provided expected caseloads, updated to reflect significant changes in statute made during the 2025 legislative session. Caseload changes in early learning include:

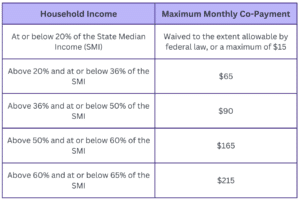

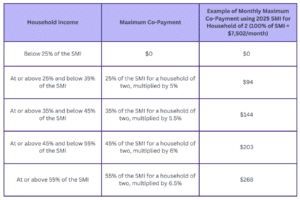

Working Connections Child Care. While ESSB 5752 of 2025 made significant revisions to the Fair Start for Kids Act, the Working Connections Child Care caseload is still projected to grow, but slower than the previously anticipated rate. This is largely due to delaying eligibility expansion from 60 percent of State Median Income to 75 percent of State Median Income.

ECEAP. The projected drop in caseload for ECEAP is largely due to the provision in ESSB 5752 that delayed ECEAP entitlement until the 2030-31 school year. The caseload forecast documents note that the funded capacity for the 2025-26 school year more closely reflects actual enrollment for the 2024-25 school year.

Transition to Kindergarten. Transition to Kindergarten (TTK) is another program where legislative changes dramatically altered the forecast. ESB 5769 changed TTK enrollment policy, providing that TTK enrollment levels would be set in the budget. The 2025-27 biennial budget froze TTK funding at the 2024-25 school year level, reducing the caseload forecast from February.

Final State Budget Action

Looking for a recap of the 2025 legislative session? Here’s a summary to spark that memory!

Governor Bob Ferguson’s May 20th action on the budgets and final policy bills sent to his desk marked the official end of the 2025 legislative session. By all accounts, this was an extremely challenging year with a staggering state revenue shortfall; a new Governor and a slew of new legislators to become acquainted with; and a number of tragic deaths that struck the legislative community.

In the end, the Legislature was able to close the state’s $16 billion four-year budget gap by enacting a budget that included a mixture of new revenue, as well as delays, reductions and cuts to existing services and programs.

For early learning, the state’s fiscal crisis necessitated delays to anticipated Fair Start for Kids Act expansions, including:

- Delay of expansion of eligibility for Working Connections Child Care to 75% of State Median Income to July 1, 2029;

- Delay of the ECEAP entitlement to the 2030-31 school year; and

- A one-year delay for the child care center rate increases for children in Working Connections Child Care (pushing the rate increase start to July 1, 2026, rather than the expected date of July 1, 2025).

Other budget savings legislators found in the early learning space came from increases in family co-payments for Working Connections Child Care; elimination of funding for the Early ECEAP of program (with maintenance of the program protected); and reduction in funding for program supports such as the Child Care Complex Needs Fund, Infant Early Childhood Mental Health Consultation and the Dual Language Rate Enhancement.

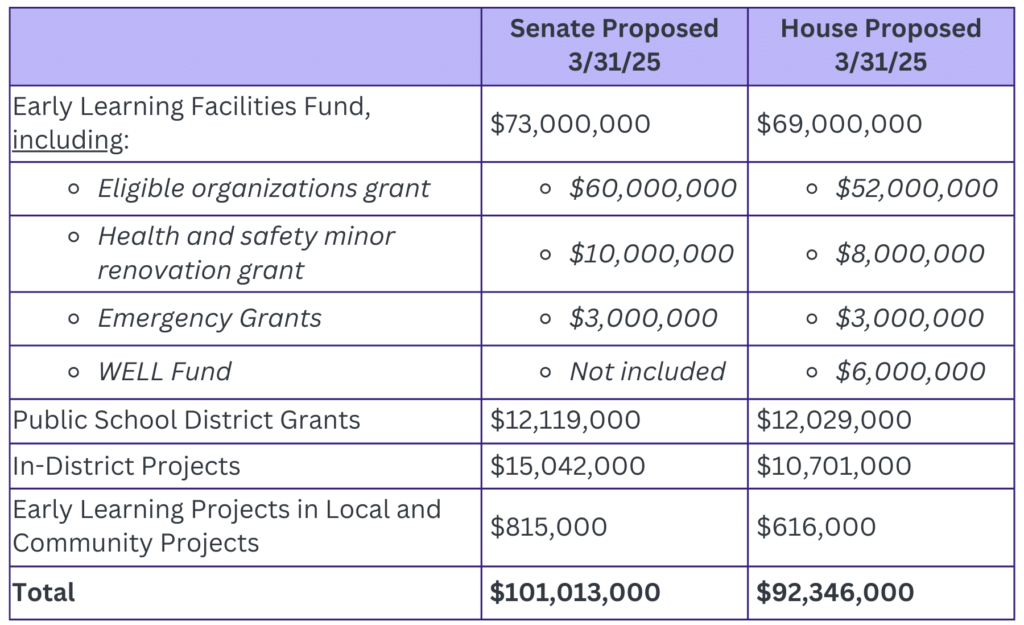

Despite the difficult budget environment, the adopted budgets did include new investments in early learning, including:

- Nearly $100 million in Capital funding for the Early Learning Facilities Fund, including $51 million for competitive grants, $9 million for minor renovation grants and $3 million for the new Emergency Fund created by newly passed HB 1314 (Callan and Abbarno).

- $383.7 million to fund the Collective Bargaining Agreement for Family Child Care providers which includes funding to increase the reimbursement rate for Working Connections Child Care to the 85th percentile of the 2024 Market Rate Survey beginning July 1, 2025.

- ECEAP providers will see a $13.9 million investment to support a 5% rate increase for full-day slots and a nearly $4 million investment for 250 full-day slots.

Looking for more detailed information? Check out Start Early Washington’s Policy and Advocacy Resources Page. There you can find:

Final Analysis of Early Learning Items in the 2025-27 Budgets