Holiday tree displayed in the Legislative Building in December 2025

(Photo Courtesy: Erica Hallock)

On Tuesday, December 23rd, the deadline for release per the State Constitution, Governor Bob Ferguson unveiled his first “solo” Supplemental Budget. The later than usual issuance was due to the Administration’s focus on responding to the aftermath of storms on the west side of the state.

Note that the Operating, Transportation and Capital budgets did not include proposed expenditures to address the magnitude of the storm impacts, but we should expect this to be a complicating factor in an already challenging budget situation.

Below you will find a breakdown of the Governor’s early learning budget proposals as well as some overall budget takeaways.

For additional detail, see Proposed 2026 Supplemental Budget and Policy Highlights; DCYF Agency Detail; the proposed Supplemental Budget bill; and Governor Ferguson’s December 23rd Supplemental Budget Rollout Press Conference.

General Budget News

Governor Proposes Two-Year Budget. In his budget materials, Governor Ferguson notes the state faces a $2.3 billion shortfall for the remainder of the 2025-27 biennium. While our state law does require our state to maintain a four-year balanced budget, like with every rule, there are exceptions. The law that created the four-year balanced budget requirement did provide that when employment growth of less than one percent is forecasted and funds are appropriated from the Budget Stabilization Account, the four-year balanced budget requirement for the subsequent biennium may be suspended.

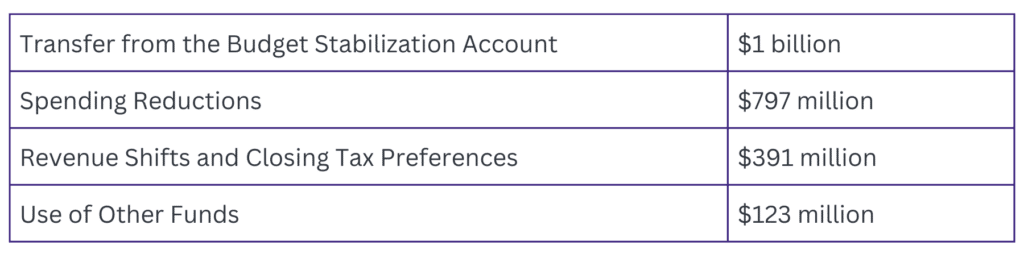

The November revenue forecast projected economic growth of 0%, and the Governor’s budget proposes transferring $1 billion from the Budget Stabilization Account, meeting the threshold for the exception of the four-year balanced budget rule. This is a long – and technical – way of sharing that Governor Ferguson proposed a Supplemental Budget focused on the 2025-27 biennium only, and he did not present a balanced budget through the 2027-29 biennia. We will see if the Legislature takes a similar path.

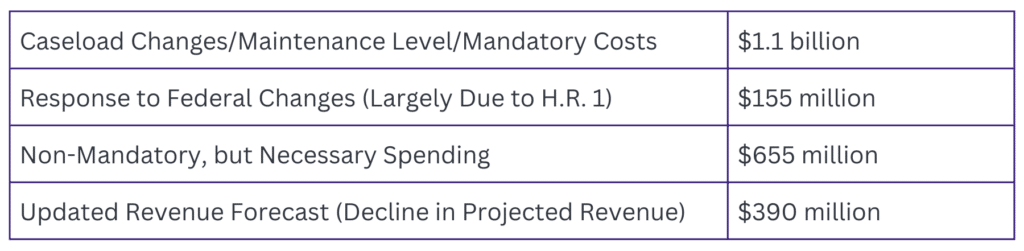

Budget Gap Breakdown

According to the Governor’s Office of Financial Management, the $2.3 billion budget gap in 2025-27 can be attributed to:

It is important to note the $155 million projected for federal changes does not reflect the full magnitude of costs associated with H.R. 1 as state costs are expected to mushroom in out years.

Governor’s Budget Ideas

Governor Ferguson proposes to close the budget gap in the following ways:

Governor Signals Openness to “Millionaire’s Tax.” During his Supplemental Budget press conference, Governor Ferguson endorsed a policy to tax people who earn more than $1 million a year. He acknowledged such a proposal would face legal challenges and would not improve the state’s current fiscal challenge but said he would sign the proposal, which is expected to raise more than $3 billion a year.

See coverage in the Washington State Standard.

Early Learning Budget

Governor Ferguson’s Supplemental Budget proposes closing the $2.3 billion budget gap for the 2025-27 biennium in part through $797 million in spending reductions. According to our math, it appears that the Governor achieves $321.81 million of these savings in proposed spending reductions to Working Connections Child Care and Transition to Kindergarten alone.

Early Childhood Education Assistance Program ($34.5 million in Private Funds). The highlight in this budget for early learning is the inclusion of the $34.5 million Ballmer Group gift to support 2000 new ECEAP slots for the 2026-27 school year.

“Soft” Working Connections Child Care Cap ($217.54 million savings). By far the largest early learning reduction (and maybe the largest cut in the entire Supplemental Budget), Governor Ferguson proposes “capping” Working Connections Child Care (WCCC) caseloads at 33,000 families effective July 1, 2026, with exceptions for immediate child welfare involved families. WCCC caseloads are projected to hit 40,000 families by July 1, 2026. Governor Ferguson proposes to achieve the 33,000 cap through “natural exits” and effectively holding new entrants until the 33,000 caseload number is achieved.

Working Connections Child Care Rates ($41.088 million reduction). Child Care Center rates for Working Connections Child Care were budgeted to be reimbursed at the 85th percentile of the 2021 market rate survey (MRS) as of July 1, 2026. However, Governor Ferguson’s budget proposes lowering the reimbursement rate to the 75th percentile on an ongoing basis. Governor Ferguson DOES propose adoption of the 2024 Market Rate Survey beginning of July 1, 2026. Under this proposal, most providers would see an increase in reimbursements, but not to the extent they would have under the original proposal to move to the 85th percentile of the 2021 MRS.

The reduction reflects the savings captured from funding rates at the 75th percentile of the 2024 MRS instead of the 85th percentile at the 2021 MRS. Note that the Governor also signals his intention to fund Family Child Care providers at the 75th percentile of the latest MRS following the next Collective Bargaining Agreement. (Family Child Care providers are currently funded at the 85th percentile of the 2021 MRS through the end of the 2025-27 biennium).

Transition to Kindergarten (TTK) Slot Reduction ($19.501 million reduction). The Governor’s budget proposes a 25% reduction in Transition to Kindergarten by reducing the number of TTK slots in the 2026-27 school year by 1,816 from 7,266 slots to 5,450 slots. The accompanying proposed budget bill directs OSPI to work with DCYF to redistribute TTK slots among schools to achieve the goals of the TTK statute.

Home Visiting Services Account (one-time $2.3 million reduction). One-time reduction of $2.3 million in the Home Visiting Services Account. This proposal would transfer an existing fund balance to the State General Fund.

Enrollment-Based Payment ($43.678 million savings). DCYF applied for a waiver from the federal government which allows states to delay implementation of rules around the enrollment-based payment policy which pays providers for care regardless of whether a child attended or not (like the private market operates). This budget item assumes the state will receive the waiver and would allow the state to discontinue the enrollment-based payment policy. Meaning, provider payment would be contingent upon child attendance.

Child Care Professional Development ($2.1 million reduction). A reduction in contracted professional development supports generating budget savings.

Capital Gains Funding Transfer from School Construction Account to the Education Legacy Trust Account ($75 million from School Construction Account to the Education Legacy Trust Account). Per existing statute, the first $500 million in annual revenue from Capital Gains funding is directed to the Education Legacy Trust Account to support early learning and K-12 education. The law provides that any funding over $500 million be directed toward the School Construction Account. This year, Governor Ferguson proposes that funding above $500 million – which totals $75 million – temporarily remains in the Education Legacy Trust Account.